Whatever Happened To Blueland After Shark Tank?

It's rare that a company gets accused of appearing on "Shark Tank" for the wrong reasons, but when it happens, it's likely to produce a range of responses from the show's celebrity investors.

Such was the case with Blueland, a seemingly revolutionary cleaning products company that aimed to tackle waste by offering consumers an alternative to single-use competitors. Career entrepreneur Sarah Paiji Yoo founded Blueland four years after selling her previous company — the mobile shopping app start-up Snapette Inc. — to the behemoth e-commerce platform PriceGrabber.com. A graduate of Harvard's Department of Economics (and later a drop-out of Harvard Business School), Yoo needed Blueland to be her next successful venture.

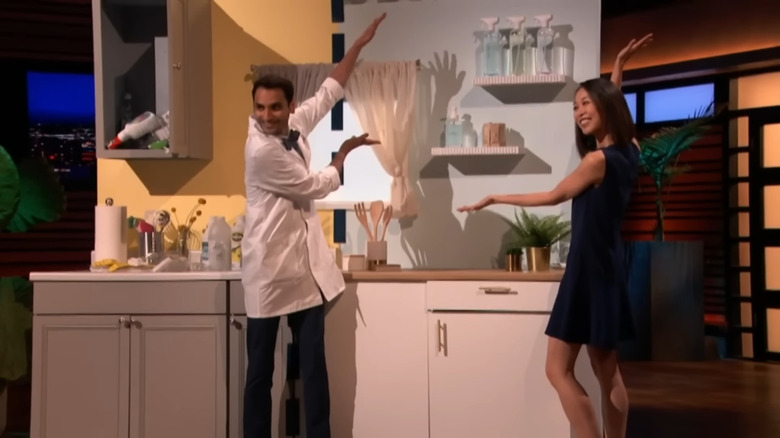

She teamed up with former Johnson & Johnson research and development scientist Syed Naqvi, who, in addition to being a co-founder, would also serve as Blueland's Head of Product. The duo entered the "Shark Tank" just two months after their online launch, hoping to add a finned financier to their investor pool of venture capitalists and fellow entrepreneurs. What they got instead was Mark Cuban calling them gold-diggers.

Mark Cuban didn't buy Blueland

When Blueland's founders enter the "Shark Tank" in Season 11, they seek $270,000 in exchange for just 2% of the company, inputting a $13.5 million valuation that already had Mark Cuban's eyebrows up to his well-kept hairline. After all, it's very similar to the $12 million valuation Simple Habit tried to sell him on back in Season 9. And while Blueland's business — which is selling dissolving cleaning-solution tablets that mix with water in reusable bottles — is a bit more solid than the suspicious meditation app, he couldn't buy Blueland's asking price.

On "Shark Tank," a gold digger is an entrepreneur who comes on the show only for the free advertisement it offers. Because of the "Shark Tank" Effect, even businesses that don't secure deals with the investors end up seeing a significant bump in sales. Thus, if the entrepreneur is confident in their product and has no real desire to partner with someone on the panel, they might offer an immovable and borderline discouraging buy-in (such as Simple Habit's $600,000 for 5%). The situation is a win-win for the entrepreneur, as they either get a large investment without giving up much of their company or a free infomercial, broadcast to millions.

Cuban seems especially frustrated by this phenomenon, as he told Forbes in 2023 that even some of his successful on-air deals turned out to be gold-diggers off-camera, leading to the partnership evaporating. Now, when he senses one on the show, Cuban has taken to openly ridiculing them, likely to make the appearance as negative as possible should it air. We can see shades of this in his incredulous and over-the-top reactions to Blueland's negotiations — but there's more to this story in particular.

Blueland had to fight to maintain its valuation -- here's why

Though Mark Cuban went out by accusing Sarah Paiji Yoo and Syed Naqvi of appearing on "Shark Tank" just for a free commercial, their situation is very different from past gold-diggers. Unlike those entrepreneurs, who brought the panel their outsized valuations seemingly in bad faith, Blueland had actually raised $3 million in capital at $13.5 million — the exact valuation they entered with. In some ways, this put the entrepreneurs in a vulnerable position, as the negotiating process was almost definitely going to lead to equity dilution.

To explain it very simply, equity dilution occurs when a business accepts funding at a lower valuation than the previous round, thus leading to a very complicated financial process that decreases the value of previous investors' shares. Those venture funds and entrepreneurs who already gave Blueland $3 million would wince with each percent Yoo agreed to part with at a reduced valuation.

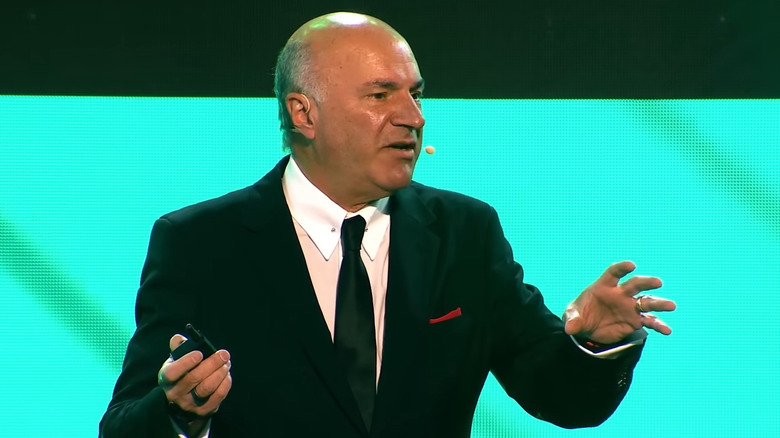

Perhaps Kevin O'Leary had this in mind when he countered guest shark Daniel Lubetzky's offer of $1 million for 25% (a brutal $10 million valuation slash) with $270,000 for 5% (plus 1% in advisory shares, another complicated financial thing we won't get into). Still, Yoo fought to get O'Leary down to 3%, knowing that even a 1% change would mean a valuation drop to under $9 million. At the last second, she smartly added a $0.50 royalty sweetener for Mr. Wonderful, earning his investment in Blueland. Little did he know, it wouldn't be long before Yoo would call him up personally and ask for one thing — a free advertisement.

Kevin O'Leary said Blueland's launch couldn't get worse

When Kevin O'Leary nabbed 3% equity in Blueland for $270,000, he was thrilled. Because of the growing public shift toward reduced plastic use and Blueland's professed potential to eliminate 5 billion plastic bottles from landfills, retailers were itching to add the product to their cleaning aisle. It was, in his words, a "smoking hot deal." But that was 2019.

Months later, after Sarah Paiji Yoo had expended $50 million (the entirety of the capital she had) preparing for their launch in the third week of February 2020, the COVID-19 pandemic began in earnest. As far as debuts go, O'Leary lamented, "It doesn't get worse." Broke and desperately needing to move $50 million in product, Yoo wanted to find a way to convince the average consumer to buy their cleaning supplies online. So, she made two phone calls.

The first was to SAG-AFTRA, the union that represents professional screen actors (O'Leary included) that was about to shut down commercial production across the country due to safety concerns. After preemptively getting the go-ahead from SAG to allow O'Leary to waive his fee, Yoo made her second call to Mr. Wonderful to ask him to fly to Brooklyn that night before production stopped at midnight — all so that he could star in an impromptu "Shark Tank"-Blueland commercial. As a result, she saved her company from the brink of bankruptcy.

A digital pivot made Blueland an overnight success -- literally

After shooting an ultra-low-budget ad starring Kevin O'Leary, Sarah Paiji Yoo began purchasing remnant ad slots on TV stations — I.e., the ads that jolt you awake in the middle of the night after you fall asleep on the couch. What she bet on, however, was that the audience such an ad reached would be magnified as lockdowns began. She was right.

According to O'Leary, businesses normally see response rates of 1.2-1.5% after airing a commercial. Blueland's response rate quickly climbed to 12%. Additionally, because Yoo had shifted from retail to direct-to-consumer, 100% of the gross margins went directly to Yoo (Blueland's margins were at 84%, according to O'Leary). Over the course of seven months, she had turned Blueland into a "cash-flow positive" business with over $1 million in sales and a run rate of $42 million per year. The company's success has continued to skyrocket ever since, thanks to its digital pivot, with the online orders also giving Blueland valuable data about what and when its customers order.

It has greatly expanded its product line as well, now offering hand soaps, dishwashing soap and detergent, laundry detergent, toilet bowl cleaner, and even basic skin care products. In short, when it comes to profitability and its eco-friendly mission, Blueland is greener than ever.

Kevin O'Leary predicts the company will be sold in a matter of months

Speaking at the Game Changers Summit (the "largest law firm growth conference on Earth") at the end of 2022, Kevin O'Leary revealed that Blueland was on track to hit $100 million in sales before the end of 2023 — at which point, he predicts that a larger company will buy the whole business. As he states, this milestone is usually when a company like Blueland would receive an offer from a competitor, as this has apparently happened with, as he says, "all of my 'Shark Tank' companies that really piss off the big guys."

As for founders Sarah Paiji Yoo and Syed Naqvi, they're both still very much involved with the company. In 2022, Naqvi was promoted from head of product to chief innovation officer, the highest position he has held at any company as of writing. Yoo, meanwhile, is still the CEO and is currently looking to hire a chief of staff to help with the company's mission and strategy.

Should a company like Procter & Gamble or S.C. Johnson fulfill O'Leary's prediction of a $100 million buyout, it will be interesting to see how they would integrate such a disruptive business like Blueland into their ranks. Would measures be taken to stop Blueland from making Tide or Windex obsolete? Would a desire to recoup their purchase price drive profit concerns to outweigh environmental ones? The answers to these questions will only become apparent when an offer emerges. Until then, Blueland and Mr. Wonderful can enjoy cleaning up the cleaning aisle in more ways than one.