What Is The Shady Advice Shark Tank Producers Give Entrepreneurs Appearing On The Show?

One of the most intense moments on "Shark Tank" comes after the entrepreneur's presentation, when it's time for them to choose a deal, if offered one. It's an important decision that will drastically affect the trajectory of their business, for better or worse, and shouldn't be taken lightly.

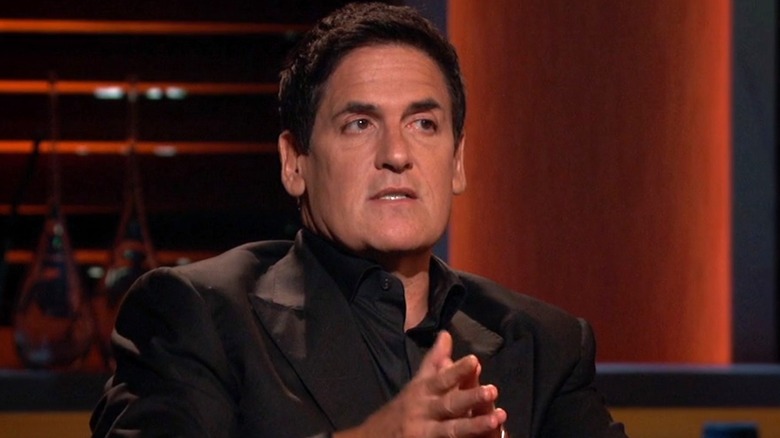

Sometimes, the deals on the table simply aren't that great, with the sharks asking for a much higher stake in the company than the entrepreneur initially envisioned. Yet many times, the entrepreneur accepts. According to a study conducted by Forbes, in which the outlet surveyed individuals who appeared on "Shark Tank," there's pressure from producers to accept the deal, even if it's not ideal for their business. If they don't accept, they run the risk of their segment — and product — not being aired. In fact, according to Forbes, shark Mark Cuban confirmed that this is accurate.

Still, nothing is set in stone, and more negotiations have to take place off-camera.

Deals can drastically change during off-camera negotiations

Entrepreneurs being pressured into a deal on camera isn't the only shady aspect of "Shark Tank" that Forbes uncovered in its survey. An analysis was conducted of 112 deals offered from Seasons 8 through 13: Only half ended up coming to fruition during those behind-the-scenes negotiations. Of those, 30% saw the terms drastically altered from what was agreed to on stage.

For the other half of the deals, which fell through, there were a few reasons why. Either both parties agreed a partnership wasn't a good fit, the shark retracted the deal for no given reason, or the deal changed so much that the entrepreneur felt it was detrimental — rather than beneficial — to work with the shark. For example, Wine Balloon inventor Eric Corti turned down a $400,000 buy-out from Lori Greiner and Mark Cuban that he initially accepted. On second thought, he realized that he still wanted to control his company.

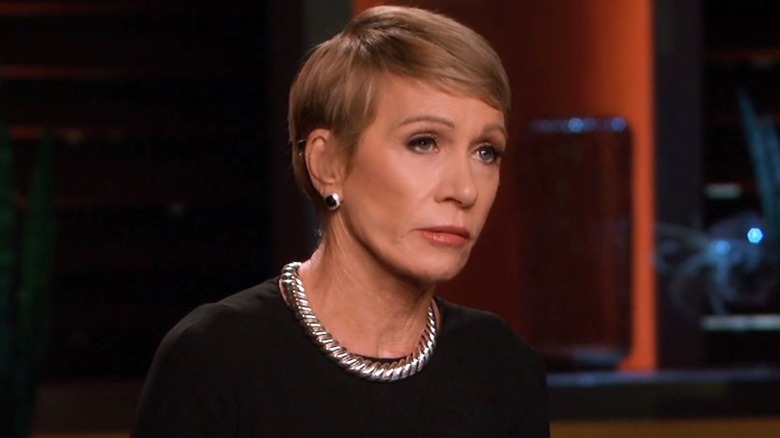

Still, a number of business owners, like The Smart Baker inventors Daniel and Stephanie Rensing, think the sometimes shady process of appearing on "Shark Tank" is worth it for the exposure. After backing out of a deal with Barbara Corcoran once the cameras stopped rolling, the Rensings are thriving with their baking equipment company. Their annual revenue increased from $130,000 to $1 million in the years that followed their "Shark Tank" appearance. Daniel told the Seattle Times, "Not doing the deal and having that exposure was probably the best scenario for us."