The Ending Of Dumb Money Explained

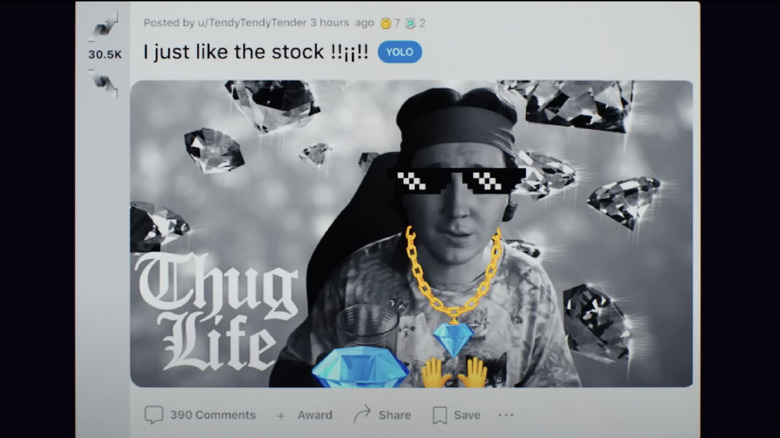

Like Adam McKay's 2015 hit "The Big Short," Craig Gillespie's "Dumb Money" attempts to unpack dry and complicated economic concepts for an audience that, perhaps, doesn't normally tune in to news about such things. To earn and maintain their attention, both McKay and Gillespie use humor, but "Dumb Money" is an entirely different kind of funny. No one's breaking the fourth wall here and Margot Robbie isn't explaining the stock market to anyone from a bathtub. "Dumb Money" isn't trying to be clever. Instead, this speedily turned-around film about the very recent GameStop short squeeze — based on the book "The Antisocial Network" by Ben Mezrich — uses the random and stupid-on-purpose comedic milieu of Gen Z to tell a pretty serious story.

There are as many misspelled YouTube comments, cat memes, and TikTok dances as can fit into a feature film about the crushing economic inequality and lack of upward mobility that young people face today. Though Gillespie's style — which relies heavily on foul language and screens within screens within screens — might not be for everybody, "Dumb Money" is accessible enough that anybody can follow along. Even so, the out-of-sequence editing, breakneck pace, highly specific online lingo, and sprawling cast of characters could leave those who got the general idea with some lingering questions. This is what goes down as GameStop's stock goes up in "Dumb Money."

What you need to remember about the plot of Dumb Money

"Dumb Money" follows Keith Gill (Paul Dano), a young husband, new father, and employee at Mass Mutual who, as a hobby, posts about stocks on Reddit and YouTube under the aliases DeepF***ingValue and Roaring Kitty respectively. He and his wife Caroline (Shailene Woodley) are living an anonymous, working-class life when his videos about his favorite stock, GameStop, go viral. Gill's hypothesis is that GameStop stock is worth more than Wall Street thinks. As such, he buys about $53,000 in stock and shares his balance sheets with his audience as his investment steadily grows.

Roaring Kitty's fans appreciate his insights, transparency, and commitment to the little guy. As it happens, several hedge funds have bet against GameStop and are hoping to see it fail. If the company does go under, tens of thousands of real people will lose their jobs, but guys like Gabe Plotkin (Seth Rogan) and Ken Griffin (Nick Offerman) will reap billions in rewards. Gill's legion falls in line and, primarily using the recently launched Robinhood app, buys up GameStop stock, too, in varying amounts. The popularity of the stock drives up the price astronomically, making Gill richer than he ever could've imagined and making his followers rich enough to pay off mortgages and student loans. But rather than cash out and drastically improve the quality of their lives, Roaring Kitty's devotees hold the line to stick it to the man ... until the hedge fund managers and the founders of the Robinhood app try to rig Roaring Kitty's game.

What does the title mean?

The hedge fund managers use the term "dumb money" derisively throughout "Dumb Money." What they mean by it is that retail traders — the type of people who invest what are, to them, small and insignificant amounts of income into the stock market — don't have the intelligence or expertise to compete alongside the big brokerages. In essence, everyone who buys stock for fun — like a lottery ticket — on Robinhood is dumb money.

Gabe Plotkin and Ken Griffin believe their leader, Gill, is dumb money because he's a YouTuber with a regular job. It's a huge deal to Gill and his wife when he puts $53,000 — essentially his life's savings — into a company that appears to be faltering, and it's not a decision he makes lightly. It is true that many of Roaring Kitty's followers don't possess his command of the fundamentals of the markets. Plotkin and Griffin are convinced the GameStop bubble will burst because the small-dollar investors will get spooked and sell en masse at the first sign that anything might go wrong. They also doubt that Gill is right about GameStop's long-term value.

But what they really mean is that working-class people who purchase stocks aren't connected enough to the elite circles that drive activity on Wall Street. The unspoken truth is, that people like Keith Gill never win because they don't have billion-dollar buyout safety nets and they don't make the rules.

What is a short squeeze?

It's ironic that GameStop's slogan is "power to the players." That's essentially the tactic that the masses took in trying to prop up their favorite stock, all while taking the banking industry nepo babies down a peg. During several of his livestreams (particularly during the ones in which he's imbibing beer or champagne), Roaring Kitty uses the word "squeeze." What's happening during most of "Dumb Money" is called a short squeeze. But to understand what a short squeeze is, one first has to understand what a short sale or short position is.

Put simply, it's a bet against a stock. The more complicated version goes like this: those who have enormous sums of money to spare — so, typically hedge fund managers (the phrase comes from hedging their bets) — borrow shares in a company that they think is going to decline or fail, in hopes they'll be able to buy them back at a profit. It's risky, so it's not something hobby traders like Keith Gill often partake in. In the film, Gabe Plotkin has bet big against GameStop. Because it's a niche service and because brick-and-mortar is falling behind online shopping, Plotkin thinks his short position will pay off in the long run. But, because the investors on r/WallStreetBets understand how short selling works, too, they're able to rally not just around GameStop as an investment choice but around the idea of bankrupting Plotkin and Melvin Capital Management. They short squeeze him and others who'd taken a short position to the tune of billions of dollars.

Who are some of the key players?

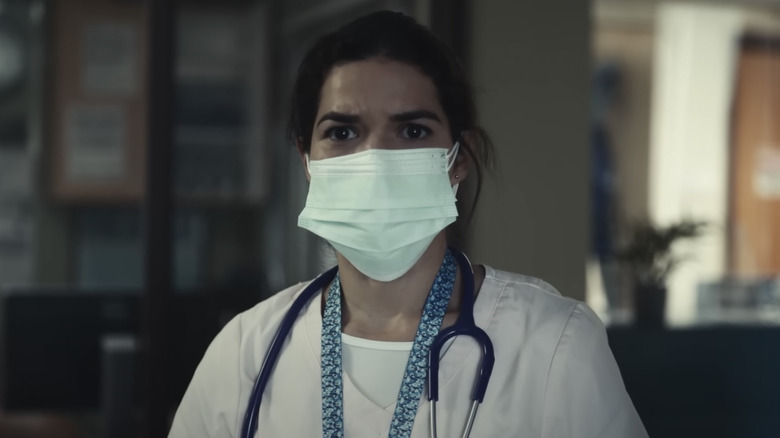

Keith Gill is the sun at the center of "Dumb Money," but a whole system of blue-collar supporting characters orbit around him, even if he doesn't know they exist. Marcus (Anthony Ramos) is a GameStop employee frustrated by the inane demands put on him by his local franchise manager and corporate. Jennifer (America Ferrara) is a divorced nurse and a single mom who wants to pay off her house (and her work friend thinks her kid needs braces). Harmony (Talia Ryder) and Riri (Myha'la Herrold) are a college couple with six-figure student loan debt. All of them snap up GameStop shares early on when the price is low, and all of them see their accounts skyrocket from near-zero balances to sums of hundreds of thousands of dollars.

The two men behind the app they're using to make all that money are Vlad Tenev (Sebastian Stan) and Baiju Bhatt (Rushi Kota). The founders of Robinhood are, at the start of the film, worth about a billion dollars each. Tenev and Bhatt enjoy being conspicuously rich, but they're trying to keep the inner workings of their innovation under wraps. Citadel — the firm run by Ken Griffin — has a stake in GameStop, and though users don't pay fees to trade, they do collect payments on order flow, or small amounts of interest, which means activity on Robinhood isn't really free.

What happens at the end of Dumb Money?

Just when GameStop stock is at its peak, the Reddit page that fed the trading frenzy, r/WallStreetBets, goes dark. That same day, Robinhood users find they aren't able to buy or sell their shares in GameStop. In the film, Harmony panics, believing that Roaring Kitty may have unloaded his fortune. She sells and is nearly $200,000 richer, but she feels like a class traitor and swears to get back in once she hears from Gill. Jennifer and Marcus hold, and their small fortunes dwindle back down to the size of a single paycheck. The Gills, who had been making millions a day, are suddenly losing that much, and news cameras are parked outside their modest home.

Unbeknownst to the meme stock crowd (though they suspect something to this effect has taken place behind the scenes), Ken Griffin of Citadel colluded with Robinhood's founders. When regulators required Baiju Bhatt and Vlad Tenev to inject $3 billion into the app (cash on hand they didn't have), Griffin and Citadel bailed them out. Suspiciously, GameStop trading froze for their customers shortly thereafter. Eventually, r/WallStreetBets goes online, as does consumers' ability to buy and sell GameStop stock. Roaring Kitty's fans see that he has held the line. But Congress is concerned about the volatility of the market and possible malpractice, and Griffin, Gabe Plotkin, Tenev, and Gill are all served subpoenas and must testify about the situation via zoom, since "Dumb Money" takes place during the pandemic.

Where does the film leave its characters?

In the final moments of "Dumb Money," the characters prepare and provide their testimony. Craig Gillespie uses real clips from the hearings, featuring real Congresspeople such as Representative Alexandria Ocasio-Cortez, cut together with footage from his dramatization. Keith Gill fears he may actually go to prison or be held accountable if any of his followers suffered losses based on his advice, despite the fact that he always included disclaimers in his live streams. Gabe Plotkin's handlers struggle to find a room in his palatial residence that looks down-to-earth enough not to alienate Congress let alone the common man. Ken Griffin has to dismiss advisors during questioning so as not to lie.

A series of title cards tells us what happens next. Keith Gill wasn't accused of manipulating markets. He and Caroline retained their stock, which now valued in the tens of millions, and went back to living anonymously. Keith buys his brother, Kevin (Pete Davidson) a new car. Harmony and Riri (who'd bought back in), Marcus, and Jennifer saw their balance sheets improve. Tenev and Bhatt, we're told, were no longer billionaires. Gabe Plotkin's Melvin Capital Management went under. But, in the end, though communication was uncovered that all but proves Citadel and Robinhood conspired to stop retail traders in order to prevent a short squeeze, neither party was held accountable.

What does the ending mean?

The poster for "Dumb Money" looks like stacks of bills at first glance, but look harder and it's clear Craig Gillespie's latest movie is sending the one percent a message. Those stacks of bills are arranged in the shape of a hand giving the middle finger. "Dumb Money" is, like Gillespie's 2017 film, "I, Tonya," another ripped-from-the-headlines retelling, but it definitely has a point of view. The director is surely interested in the often juvenile and sometimes offensive story of Keith Gill's viral fame — the R-word is used casually and repeatedly, and Jennifer's Black friend points out that the community she's become a part of is a cesspool — but he's more interested in what the meme stock phenomenon has to say about the American economic ladder.

In text and in conversation, Gillespie makes it clear that America is increasingly a place of haves and have-nots, without much of a middle class in-between. The investors are worth many billions of dollars. Their biggest problems are ketchup stains on their pants and tennis court construction falling behind schedule. The workers have net worths in the negative. Hourly pay simply will never be sufficient to wipe out their debt. Meme stocks aren't realistically a solution to economic disparity, but Gillespie closes out "Dumb Money" on an emotional high note. He suggests that Keith Gill and his cohorts taught Wall Street a lesson and notes that hedge funds have made fewer and smaller bets against companies, like GameStop, since the short squeeze.

Is Dumb Money a true story?

The trailer for "Dumb Money" claims the movie is based on an "insane" true story. Since the GameStop stock saga was regularly in the news in 2021, most viewers will probably remember at least bits and pieces of it. But movies that are based on true stories aren't always entirely true. Sometimes, as was the case most recently in "Gran Turismo," the story is told out of order and the majority of the characters are composited or wholly fictionalized. So what's real and what isn't in "Dumb Money?"

Keith and Caroline Gill, as well as his brother Kevin, and his parents Steven and Elaine are all actual people, and sadly, the Gill family did lose Sarah — Keith's sister — in 2020 as is depicted in a very minor subplot in "Dumb Money." So too are Citadel's Ken Griffin, Melvin's Gabe Plotkin, and Robinhood's Vlad Tenev and Baiju Bhatt. On the other hand, the blue-collar investors who jump onto Roaring Kitty's bandwagon — Marcus, Jennifer, Riri, and Harmony — appear to be stand-ins.

Broadly speaking, the events are depicted as they happened, and the specifics — dollar amounts, dates — are accurate. Though Gillespie starts out at the crisis point and then flashes back to the beginning, the timeline isn't falsified for drama. Griffin claimed to the press that he reached out to Sony to correct certain aspects of the film, but the screenwriters have disputed that any changes were made on his behalf.

What has the cast and crew said about Dumb Money?

"Dumb Money" had its world premiere at this year's Toronto International Film Festival. The ongoing SAG-AFTRA and WGA strikes meant that the strong ensemble cast couldn't be in attendance to promote the film, but the Directors Guild of America has reached an agreement with the studios, so most directors — "Dumb Money's" Craig Gillespie included — were on hand at TIFF to walk the red carpet and answer questions.

Gillespie told audiences that one reason he was so interested in the subject matter was that his own son followed the GameStop stock phenomenon during their time at home in quarantine. Gillespie said the film reflects the intensity that was present in his own household as well as "the outrage and the frustration" that happened when Citadel and Robinhood tried to tie small-time investors' hands behind their backs. But more importantly, the director said that "Dumb Money" is a commentary on the disparity of wealth that's become such a part of our society and so front-and-center in the public conversation.

Gillespie also spoke with Screenrant about the film. He points out that "Dumb Money" isn't about the one percent so much as it is the .01 percent, and he had high praise for Paul Dano, calling Keith Gill "a deceivingly complicated role." "We've got this character, or this real person," Gillespie continued, "that eight million people rallied behind on WallStreetBets, and to find out why and what that quality was about him that engaged everybody."